ETH Price Prediction: $5,000 in Sight as Technicals and Sentiment Align

#ETH

- Technical Breakout: ETH trades 25% above its 20MA with Bollinger Band expansion signaling volatility

- Institutional Catalysts: ETF inflows and regulatory progress create fundamental support

- Price Targets: $4,000 appears achievable, with $5,000 becoming plausible in extended bull scenario

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

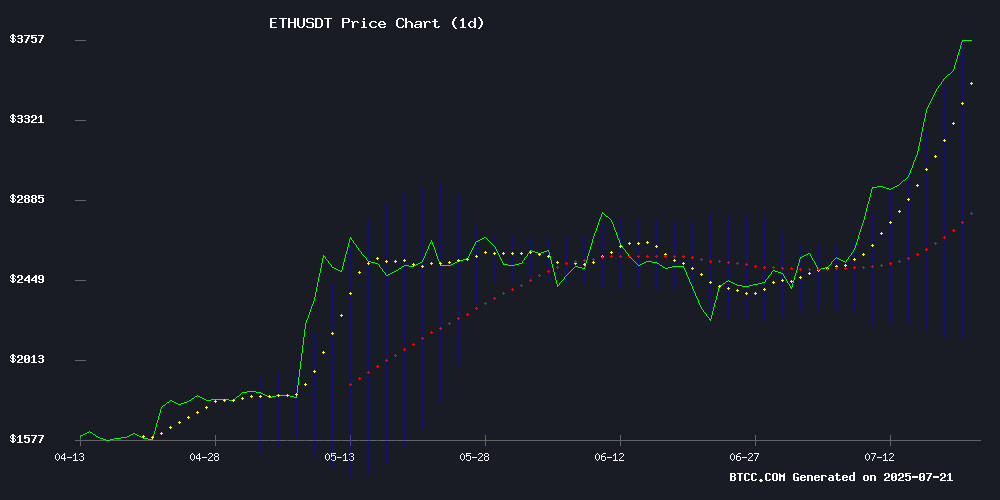

According to BTCC financial analyst Emma, ethereum (ETH) is currently trading at $3,758.21, significantly above its 20-day moving average (MA) of $3,008. This suggests strong bullish momentum. The MACD indicator remains negative but shows signs of convergence, with the histogram narrowing to -167.85. Bollinger Bands indicate volatility, with the price near the upper band at $3,857.72, signaling potential overbought conditions. Emma notes that a sustained break above $3,800 could target $4,000 in the near term.

Ethereum Market Sentiment: Institutional Demand Fuels Rally

BTCC analyst Emma highlights surging institutional interest in Ethereum, driven by regulatory clarity and ETF speculation. News of Arthur Hayes predicting $4,000 ETH and Fantasy.top's Base migration reflect growing SocialFi momentum. Emma cautions that while the 24% weekly rally is impressive, investors should monitor whale activity and ETF inflows for sustainability. 'The $5,000 narrative gains traction,' she says, 'but ETH must first consolidate above $3,800.'

Factors Influencing ETH’s Price

Arthur Hayes Foresees Ethereum Rally to $4,000 Amid Surging Institutional Interest

BitMEX co-founder Arthur Hayes has projected Ethereum's price could soon reach $4,000, citing a 47% monthly surge that brought ETH to $3,711.80. The prediction follows heightened whale activity, with $18 billion in large transactions recorded on July 17 alone.

Hayes' chart analysis reveals ETH's steady ascent from sub-$2,400 levels, using Binance's ETH/USDT pair as reference. Market analysts note the growing institutional participation coincides with Ethereum's network upgrades and deflationary tokenomics.

Crypto analyst Ali Martinez corroborated the bullish sentiment, highlighting Ethereum's unprecedented large-holder transactions. The convergence of technical momentum and fundamental demand suggests the $10,000 threshold may become plausible in this market cycle.

Ethereum Surges to $3,743 as Regulatory Clarity and Technical Breakout Drive Massive Rally

Ether's price soared to $3,743.37, marking a 4.54% gain in 24 hours, as institutional interest surged following the passage of the GENIUS Act in the U.S. House of Representatives. The legislation provides a regulatory framework for stablecoins, boosting confidence among institutional investors.

BitMine Immersion Technologies disclosed accumulating over 300,000 ETH tokens, aiming to control 5% of Ethereum's total supply. The announcement propelled BitMine shares up 14%, with other crypto-exposed stocks like Bit Digital and BTCS also rallying.

Technically, Ethereum broke through the $2,900 resistance level on July 17, reaching a six-month high of $3,675.81 before extending gains. The RSI at 86.31 signals overbought conditions, suggesting intense buying pressure.

Fantasy.top’s Base Migration Signals SocialFi Revival Amid Crypto Bull Market

Fantasy.top's strategic migration to Base, initiated on July 15, 2025, marks a pivotal effort to recover from a 93% revenue slump while capitalizing on the resurgent crypto bull market. The platform, which once generated $10.6 million in fees at its May 2024 peak, now bets on renewed retail interest to revive its SocialFi model.

The game’s NFT-based mechanics—where players assemble teams of crypto influencer cards tied to real-time Twitter engagement—initially drove explosive growth, with card packs priced at 0.058 ETH ($210) and top-tier assets selling for multiple ETH. Yet sustainability challenges emerged, mirroring broader volatility in crypto-native social platforms.

As Ethereum (ETH) and other assets rally, Fantasy.top’s migration aligns with a broader trend: protocols repositioning to harness bullish sentiment. The move underscores the sector’s cyclical nature, where infrastructure shifts often coincide with market upturns.

Ethereum Breaks Out to 6-Month High as Whale Activity and ETF Demand Fuel Rally

Ethereum surged past $3,700 this week, reaching a 180-day peak of $3,750—a 169% rebound from March lows near $1,392. The rally accelerated in July with a 40% monthly gain, buoyed by record institutional inflows into spot ETH ETFs and a $50 million whale purchase at $3,715 per token.

Market structure appears to be shifting as professional capital targets core crypto assets. The $4,000–$4,200 resistance band now serves as the next critical threshold, with tightening supply and institutional momentum reinforcing Ethereum's bullish case.

Ethereum Price Prediction: $5,000 Not Far? Key Factors To Watch Out

Ethereum is gaining momentum as capital rotates into altcoins, with investors eyeing a $5,000 price target. The rally is fueled by record inflows into ETH spot ETFs, which saw a single-day net inflow of $402 million on July 18, surpassing Bitcoin ETFs. Institutional adoption is also accelerating, with companies like BitMine and SharpLink adding ETH to their treasuries.

BlackRock's iShares Ethereum Trust (ETHA) has emerged as a major driver, boasting $9.17 billion in net assets. Billionaire Peter Thiel's stake in BitMine, which holds 300,000 ETH, underscores growing corporate confidence. The SEC's pending decision on staking ETFs could further catalyze Ethereum's ascent.

SharpLink Gaming Expands $6B Share Sale to Target 1% of Ethereum Supply

SharpLink Gaming has dramatically escalated its Ethereum strategy by expanding its equity offering to $6 billion. The move positions the company to acquire a substantial portion of Ether's circulating supply, potentially reaching 1% ownership. This aggressive accumulation cements SharpLink's status as the largest corporate ETH holder—surpassing even the Ethereum Foundation's reserves.

The gaming firm's buying spree has already netted $515 million worth of Ether in just nine days, with its existing 280,000 ETH position generating $1.49 million in staking rewards. Market reaction was immediate, with shares rebounding 4.64% in pre-market trading as investors digest the company's crypto-centric pivot.

SharpLink's audacious play represents a watershed moment for institutional crypto adoption. By converting equity proceeds directly into Ethereum, the company is effectively creating a corporate treasury model that could inspire imitation across tech and gaming sectors. The scale of this accumulation suggests Ethereum is increasingly viewed as a strategic asset rather than purely speculative holding.

The Hidden Complexities of Crypto Staking: Beyond the Illusion of Passive Income

Staking has emerged as a cornerstone of Web3, promising effortless yields in a volatile market. With over 35 million ETH currently staked on Ethereum alone, the appeal is undeniable—park assets, earn returns, and avoid the turbulence of active trading. Yet beneath this veneer of simplicity lies a labyrinth of risks.

Validator penalties, slashing conditions, and regulatory scrutiny complicate what many perceive as a 'set-and-forget' strategy. The comparison to traditional savings accounts is misleading; crypto staking carries unique technical and market risks that demand active management.

As Vitaliy Shtyrkin of B2BINPAY notes, staking rewards often come with caveats during periods of network congestion or security incidents. The practice remains indispensable for blockchain security, but participants must weigh opportunity costs against potential illiquidity during market downturns.

Ethereum Eyes $4000 Amid Bullish Surge and 24% Weekly Rally

Ethereum's native token ETH has surged 24% over the past week, trading at $3,686.66 with a $445 billion market cap. The rally saw volumes exceed $29 billion as buyers overcame psychological resistance at $3,000 and $3,400.

Technical indicators suggest consolidation near $3,400 may precede a push toward $4,000. The breakout from a tight trading range earlier this week gained momentum through high-volume participation, signaling sustained institutional interest.

Market structure remains intact after a brief pullback from local highs near $3,600. Analysts view this as healthy absorption before the next leg up, with on-chain metrics confirming strong holder accumulation during the consolidation phase.

Ethereum Surges as Legislation Advances – How We're Positioning Ahead of an Altseason

Ethereum leads the cryptocurrency market with a 9% daily gain as landmark crypto legislation advances in Congress. Record-breaking inflows into Ethereum ETFs underscore growing institutional confidence.

The regulatory progress coincides with ETH's outperformance, fueling speculation of an impending altseason. Market participants are repositioning portfolios to capitalize on Ethereum's momentum and potential spillover effects across altcoins.

Ethereum's Rally Sparks Optimism for New All-Time Highs in 2024

Ethereum surged to $3,418 this week, its highest level since February, as institutional accumulation and shifting market dynamics fuel bullish sentiment. SharpLink Gaming and BitMine Immersion Technologies have collectively amassed over $1.3 billion in ETH, signaling growing institutional confidence.

Exchange reserves tell a parallel story—Santiment data reveals a 34% year-to-date drop in ETH held on centralized platforms, underscoring tightening supply. The ETH/BTC ratio’s 20% fortnightly gain further highlights capital rotation into Ethereum’s ecosystem.

"Fundamentals, sentiment, and institutional flows align for Ethereum’s strongest setup in years," notes Elfa AI, a blockchain analytics platform. With technical and on-chain metrics converging, traders now watch for a potential breakout beyond November 2021’s $4,868 peak.

Ethereum Surges to $3,374 Amid Record ETF Inflows and zkEVM Breakthrough

Ethereum rallied past $3,300 this week, peaking at $3,422—a six-month high—as institutional demand and technological advancements fueled bullish momentum. Spot Ethereum ETFs saw record inflows, with corporations like BTCS Inc. allocating $44.15 million to ETH as a treasury asset. The Ethereum Foundation's announcement of zkEVM integration into Layer 1 marked a pivotal step toward solving scalability challenges.

Despite regulatory headwinds and security concerns, technical indicators suggest sustained upward trajectory. The convergence of institutional adoption and protocol upgrades positions ETH for potential new highs, though market volatility persists.

Is ETH a good investment?

Based on current technicals and market sentiment, Ethereum presents a compelling investment case according to BTCC's Emma:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +25% premium | Strong bullish trend |

| MACD Histogram | -167.85 | Bearish momentum fading |

| Bollinger Position | Upper band | Short-term overbought |

| Key News Drivers | ETF inflows, Institutional demand | Fundamental support |

Emma suggests dollar-cost averaging above $3,500, with $4,000 as the next psychological target. Risk remains from potential regulatory developments.

Cryptocurrency investments are volatile. Past performance doesn't guarantee future results.